2.6 Tax Policies

Tax Policies

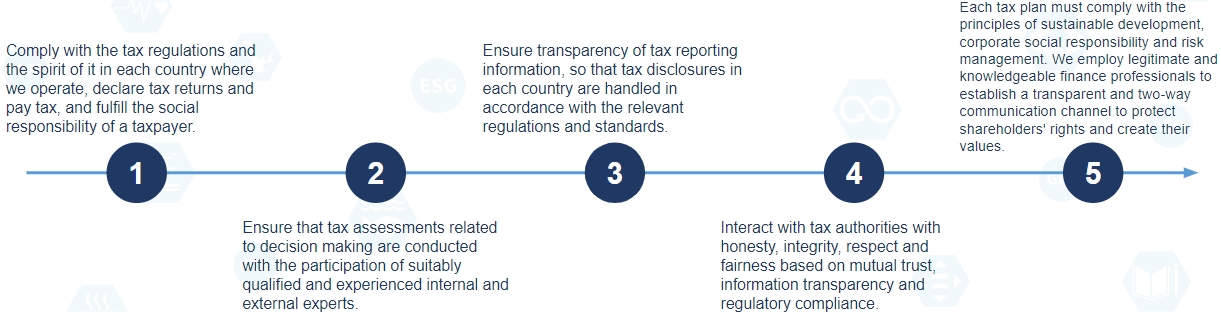

In response to the international trend of tax governance and the increasingly complex multinational tax environment, TransAct supports the government in promoting tax preference, upholds the principle of being an honest taxpayer, and fulfills the obligations of corporate citizens. Under the control of tax governance risks, we promote the development of local economy and employment as well as the vision of industrial innovation policies, to achieve sustainable management and implement sustainable development. TransAct does not use tax havens for the purpose of tax avoidance. To fulfill corporate social responsibility and increase shareholders' benefits, we promote the five principles of implementing tax policy, regularly review our tax management practices by Juncheng Accounting Firm (濬誠合署會計師事務所), and report to the board of directors every six months on tax management.