3.2 Climate Change Risk and Opportunity(TCFD)

Financial Impact of Climate Change Analysis, Risk and Opportunity

The UN Intergovernmental Panel on Climate Change estimates that the total global economic loss at the end of the century will be $54 trillion if global temperatures rise by 1.5°C, and $69 trillion if temperatures rise by 2°C.

Climate change has created a systemic crisis. Scientists, governments and companies are working together to understand the risks of climate change, find ways to reduce them and turn them into new opportunities. While boards of directors around the world must be aware of the threat of global warming, the timeline of the plans is not long enough to consider the long-term effects of global warming; it is often impossible to draw on history, we can only plan for the future under unknown circumstances.

Without implementing climate improvement programs that keep pace with the times, the company will have an impact and create uncertainty for the future business operations. TransAct strives to enable companies to understand the level of sustainability of their business activities and assets through the patented O2O2O system online platform which is one of the keys to a quick and smooth transition to a low-carbon economy. (201-2) Compared to other competitors, the sooner they accept new ideas and introduce new technologies, the bigger chance they will become the winner when moving towards Net Zero.

There is still a long way to go to reduce global warming, and it will require not only a change in business taxes and asset allocation but also a change in the mindset of sustainability for all. That's why we insist that companies must not greenwash and claim that environmental sustainability programs have been done while we're proactively counseling companies on sustainable business development.

In the face of climate change, analyzing, setting short-, medium- and long-term goals and providing flexible supply chain application tools are the keys and opportunities for TransAct to help the companies to survive. As global climate change intensifies, TransAct believes the key word is "decarbonization": all industries, companies and individuals must pay attention and make contributions. Only by incorporating sustainable DNA and risk scenarios into the assessment and by reorganizing and integrating internal audit and control processes can we stimulate enterprises to optimize and upgrade their management of climate change risks, enhance their resilience and breakthrough the unknown challenges.

.jpg)

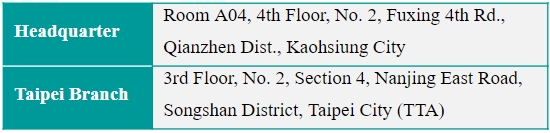

Organizational Boundary

Climate Risk and Opportunity Strategy

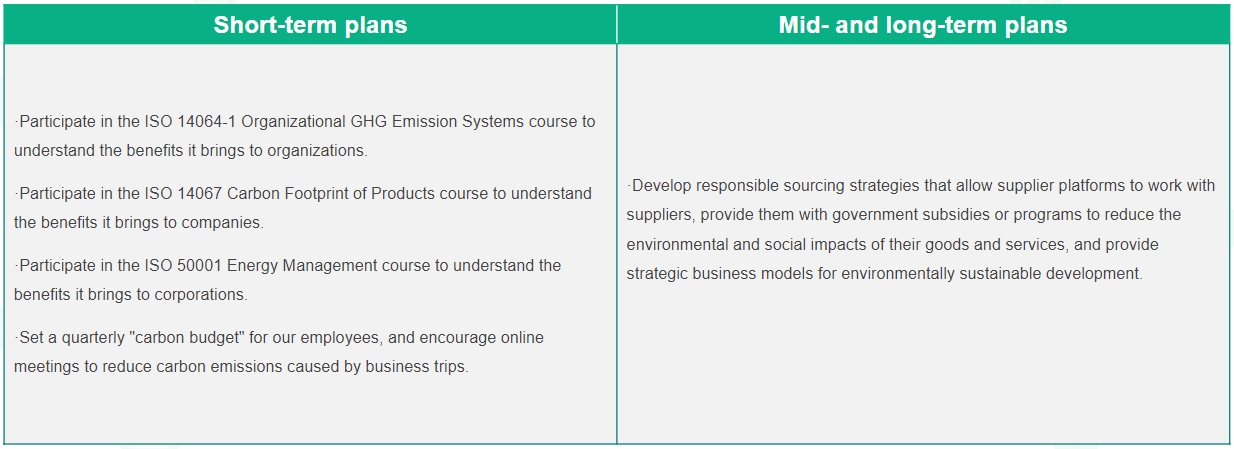

TransAct reports the short-, medium- and long-term risks and opportunities arising from climate change according to TCFD recommendations.

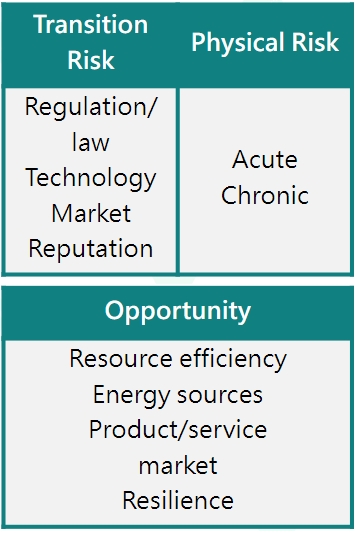

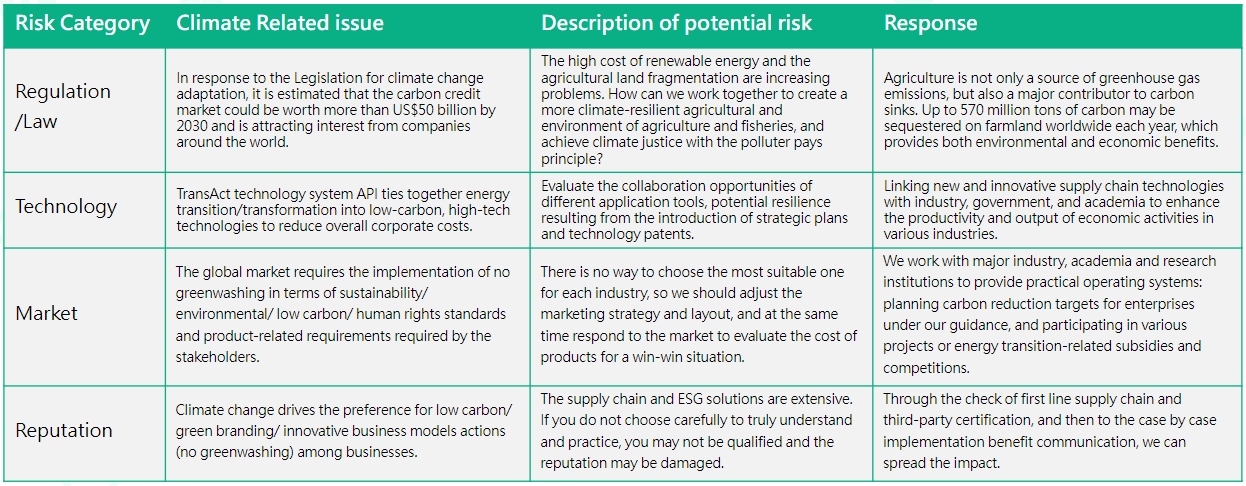

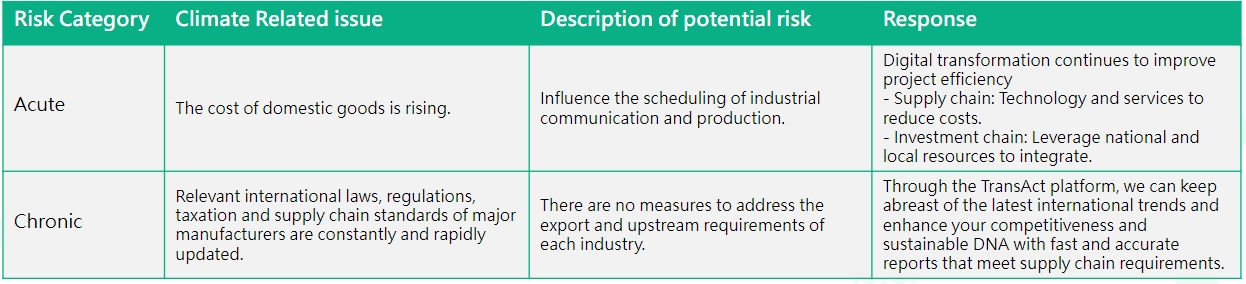

To date, the risks and opportunities associated with the impact of climate change have been highly affected across industries, representing both opportunities and risks. TransAct uses scenario analysis and follows the five basic principles of scenario analysis. The risks are divided into transition risks and physical risks to illustrate the potential risks and opportunities in the face of climate change to understand the various possible future conditions and to know how to respond to these future uncertainties. By using different assumptions and considerations, we assess the possible future state of a certain degree of climate change. Transition risk includes policy and regulation, technology, market and reputation; physical risk is divided into immediate and chronic (e.g., application of tools for a more diversified supply chain).

Related opportunities include resource efficiency, energy sources, products/services, markets and resilience.

Short-term Strategy

The current operating locations of TransAct are not listed under the Greenhouse Gas Reduction and Management Act as requiring greenhouse gas inventory.

Plan opportunities for company stakeholders to participate in ISO education training to increase the image of sustainability.

Education and training are beneficial to the implementation of TransAct's environmental sustainability efforts, and are included in the sustainability report to inform investors of TransAct's environmental sustainability efforts.

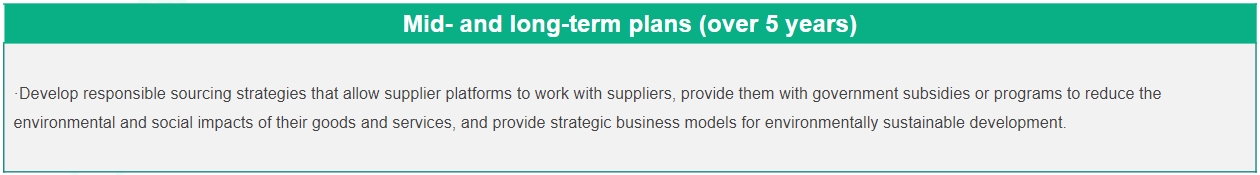

Mid- and Long-term Strategy

There is still a long way to go to reduce global warming, and it will require not only a change in business taxes and asset allocation but also a change in the mindset of sustainability for all. That's why we insist that companies must not greenwash and claim that environmental sustainability programs have been done while we're proactively counseling companies on sustainable business development.

In the face of climate change, analyzing, setting short-, medium- and long-term goals and providing flexible supply chain application tools are the keys and opportunities for TransAct to help the companies to survive. As global climate change intensifies, TransAct believes the key word is "decarbonization": all industries, companies and individuals must pay attention and make contributions. Only by incorporating sustainable DNA and risk scenarios into the assessment and by reorganizing and integrating internal audit and control processes can we stimulate enterprises to optimize and upgrade their management of climate change risks, enhance their resilience and breakthrough the unknown challenges.

Risk Management

Investors and other stakeholders need to understand how the organization identifies, assesses and manages climate-related risks and whether the identification process is integrated into existing risk management processes. The information is used to assist users of climate financial disclosures to assess the organization's overall risk profile and risk management activities.

The risk management system of TransAct is to identify and analyze the risks faced by the company.

We implement risk management to ensure the proper operation of the company, create value for the stakeholders and achieve the company’s sustainable development goals.

Search for industry information and events in other countries or companies; and the information is used to consider transition risk and physical risk.

Transition Risk

Physical Risk

Climate Opportunity

Physical Risk

The annual inventory of greenhouse gas emissions is published in the Sustainability Report - Environmental Sustainability section.

Estimated annual reduction target for 2023: Annual greenhouse gas emissions will be reduced by more than 1%.